Latest Posts

-

What Happens If You Haven’t Filed Taxes in Years — and How to Fix It

Haven’t filed taxes in years? Learn the risks and how a CPA can help you catch up safely and avoid IRS penalties.

-

How to Save Thousands in Taxes with an S-Corp

The S-Corp isn’t a one-size-fits-all solution. It comes with added responsibilities—like running payroll, filing a separate tax return, and staying on top of compliance. But for most profitable businesses, the tax savings far outweigh the extra effort.

-

5 Overlooked Illinois Tax Credits That Could Boost Your Refund

You should know about these 5 Illinois tax breaks that you may qualify for but probably aren’t using.

-

✅ How This Idaho Couple Found Tax Relief After Years of Unfiled Returns

After years of fear and unfiled taxes, this North Idaho couple found peace of mind and a fresh financial start—with help from Tax Rescue CPA.

-

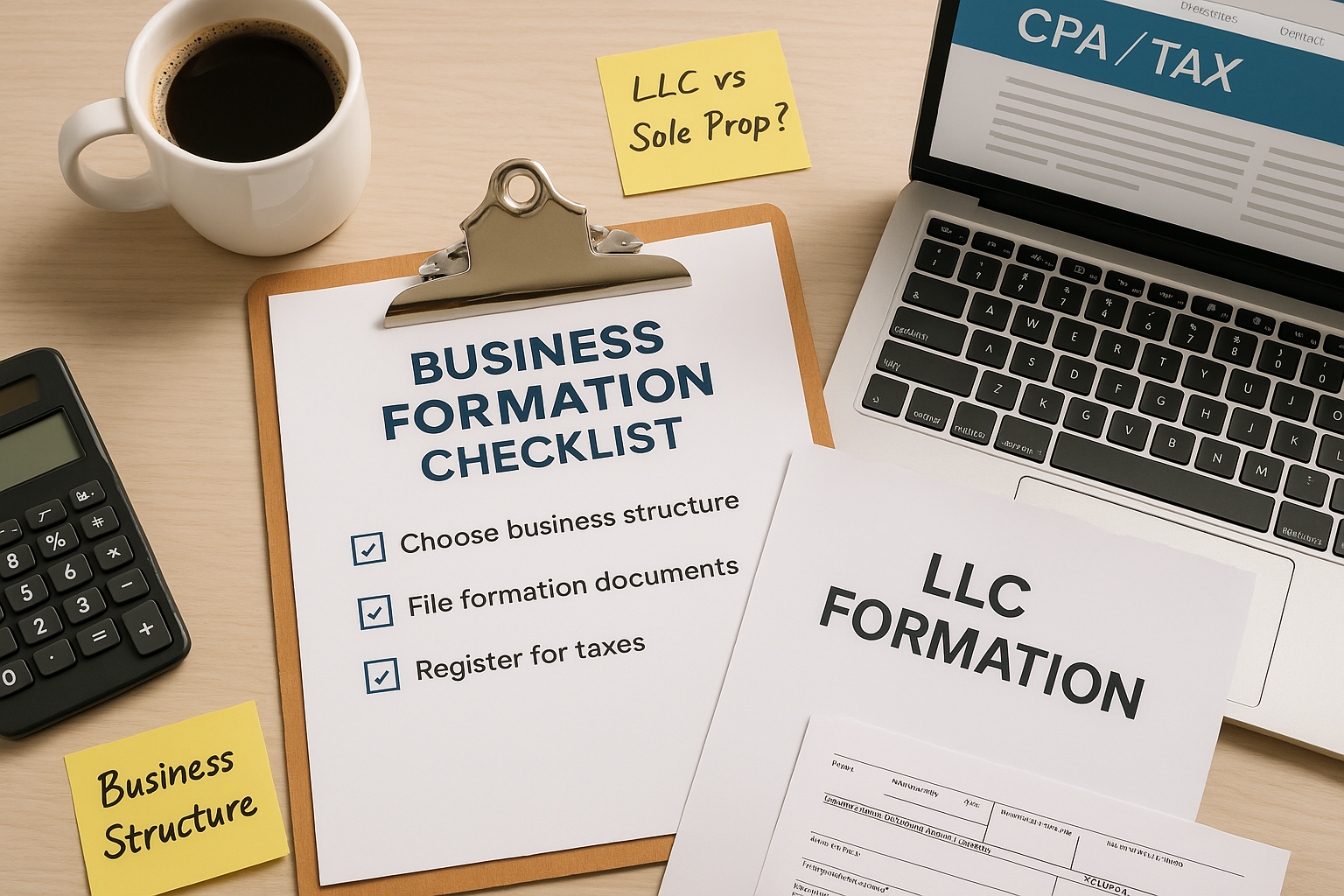

How to Set Up an LLC: A Simple Guide for Beginners

Starting a business? This quick guide shows you how to set up an LLC step by step—including an optional tax-saving S-Corp election.

-

Did You Miss the April 15th Tax Deadline? Here’s What to Do Now

Time ran out, but all is not lost. Here’s how to get caught up, minimize damage, and get the IRS off your back—starting today.

-

CPA Explains Why You Should Use an LLC for Your New Business

Thinking of starting a business? A CPA with 25+ years of experience breaks down why an LLC is the smart choice for most new owners—offering liability protection, tax flexibility, and credibility without the corporate hassle.

Jeff Roltgen, CPA

Hello, my name is Jeff Roltgen and along with my team, I help folks with taxes. I have created a process to make tax filing super easy, efficient, and affordable – I know you’re going to love it. Let’s get you filed and keep you righteous with the IRS!

Must Read

Categories

Fix IRS Problems (11) Government Money (1) IRS Audit (1) IRS Debt (35) IRS Money (1) IRS Penalties (2) IRS Tax (19) IRS Tax Debt (1) IRS Taxes (8) Payroll Taxes (2) Savings (1) Stimulus Check (3) Tax Debt (3) Tax Filing (2) Tax Planning (2) Tax Problems (2) Tax Resolution (29) Year-end Planning (1)