Starting a new business is exciting—but it also comes with a long list of decisions to make. One of the most important? Choosing the right legal structure for your business.

As a CPA with over 25 years of experience, and I’ve helped hundreds of new business owners get started on the right foot. One of the most common questions I get is: “Should I be a sole proprietor, an LLC, or a corporation?”

Let’s break it down together—because your choice can have lasting impacts on your taxes, liability, and future growth.

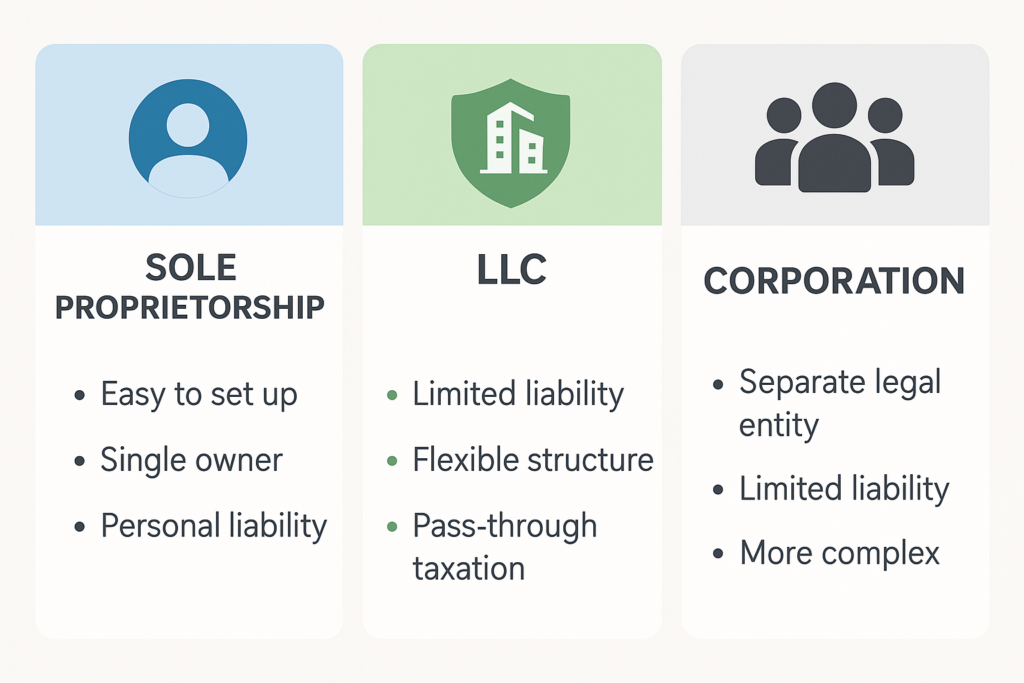

Each structure has its pros and cons:

- A sole proprietorship is the simplest and cheapest option—but it offers no liability protection.

- A corporation can offer strong protection and structure—but comes with more paperwork, formalities, and rigid compliance rules.

So where does that leave the LLC?

Right in the sweet middle spot.

Why Choose an LLC as Your Business Structure?

Here are the top 4 reasons I recommend an LLC to MOST new business owners:

- Professional Credibility

Having “LLC” at the end of your business name adds instant credibility. It shows the world, well mainly customers and vendors, you’re not just winging it—you’ve taken steps to make your business official.

- Easier Compliance & Fewer Formalities

Compared to a corporation, an LLC is a breeze to manage. You won’t need to hold shareholder meetings or follow rigid recordkeeping requirements. You still get liability protection, just with a lot less red tape.

- Liability Protection

This is the big one. An LLC separates your personal assets from your business. That means if something goes wrong—like a lawsuit or unpaid business debt—your home, your car, and your personal savings are usually protected. Be sure to consult your lawyer for details.

- Tax Flexibility

LLCs give you options:

- A single-member LLC is taxed like a sole proprietorship, by default

- A multi-member LLC is taxed like a partnership, by default

Or, you can ELECT S-Corp taxation by filing IRS Form 2553. This lets you split your income between salary and distributions—potentially saving thousands in self-employment tax.

⚠️ One Word of Caution

LLCs are great—but they’re not free to maintain.

Every state charges an annual fee or filing requirement. Some are minimal (like Ohio and South Carolina—no annual fee!). Others are steep, like:

- California – $800 minimum per year

- New York, Nevada, and Massachusetts – Higher costs and extra paperwork

Always check your state’s rules before you file.

Ready to Set Up Your LLC?

We’ve got videos and guides that walk you through the process step-by-step—be sure to check those out if you’re DIY-ing your setup.

Final Thoughts

For most new business owners, an LLC strikes the perfect balance: legal protection, tax flexibility, and ease of use. It’s no wonder it’s the most popular choice out there.

At Tax Rescue CPA, we specialize in helping individuals and small business owners file accurately and avoid tax trouble.

“Who’s Saving You Taxes?” – Tax Rescue CPA